US yields fall as Fed cut bets climb, while USD/JPY steadies ahead of NFP. Dollar divergence highlights risk of a rebound if payrolls beat.

By : Matt Simpson, Market Analyst

The US dollar is diverging from falling Treasury yields as traders price in aggressive Fed cuts ahead of Friday’s Nonfarm Payrolls (NFP). While yields slide to multi-month lows, USD/JPY is holding firm — a setup that could leave dollar bears vulnerable if payrolls beat expectations.

View related analysis:

- US Jobs Outlook: Payroll Declines, Rising Wages Test USD, Fed Policy

- So how good is APD at predicting NFP, anyway?

- AUD/JPY Outlook: First 10-Day Rally in 10 Years Faces Resistance

- USD/JPY, AUD/USD Outlook: Volatility Within Range as US Dollar Rallies

US Dollar and Yields Diverge as Fed Cut Bets Dominate Ahead of NFP

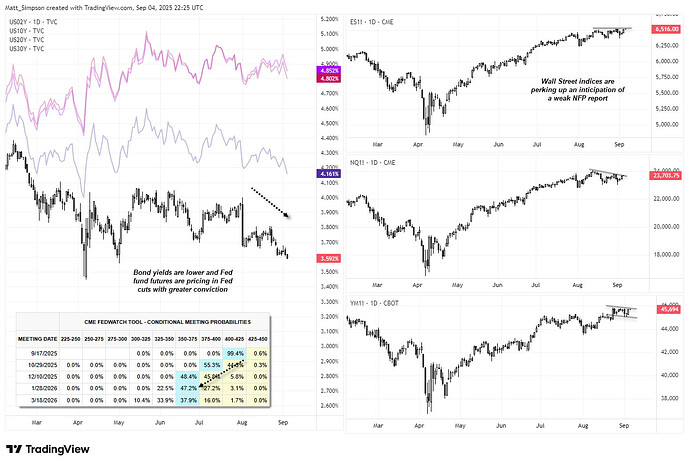

The US yield curve extended its decline for a second session on Wednesday, with a weak ADP employment report reinforcing bets of a Fed cut. The 2-year yield — the most sensitive to Fed policy expectations — slipped to an 11-month low of 3.59%. The 10-year fell to a five-month low of 4.16%, while the 20- and 30-year yields eased to 4.8% and 4.85% respectively. In Japan, smooth bond auctions alleviated fears of rising global yields, removing a key source of risk aversion and helping Wall Street indices recover. Nasdaq 100 led the way with a 0.9% gain, S&P 500 and Dow Jones futures were up 0.8%.

Fed funds futures now imply a 99% chance of a 25bp cut in September and a 55% chance of another in October. Markets are also pricing a 48.4% chance of a third consecutive cut in December. Despite lower yields and rising expectations of Fed cuts, the US dollar was higher on safety flows, as a weak US job market points to lower global growth.

Chart analysis by Matt Simpson, Source: TradingView, CME, CBOT Futures

US Labour Market Weakness Raises Risk of NFP Surprise

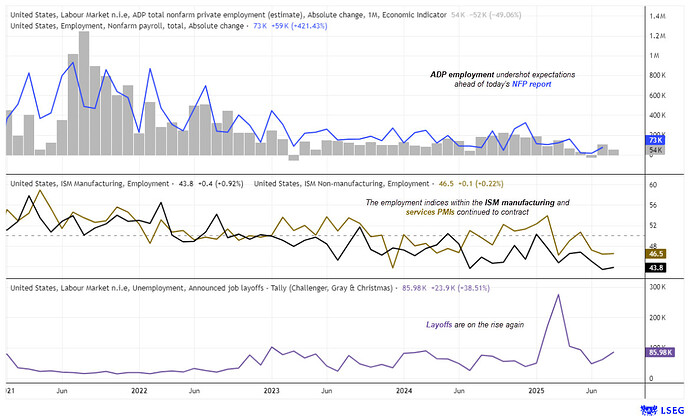

ADP payrolls rose just 55k in August, down from 104k previously and short of the 73k consensus. Job cuts also climbed to 85.9k, up from 62.1k a year earlier — a 13.1% increase. Meanwhile, this week’s ISM surveys signalled further weakness in employment, with both manufacturing and services indices remaining in contraction.

The Fed’s Beige Book also highlighted sluggish labour market conditions. Fed member John Williams projected unemployment to rise towards 4.5% next year, though he noted reduced risks of sustained inflation from Trump’s tariffs. Together, these developments raise the risk of a soft Nonfarm Payrolls (NFP) report — but if expectations prove too pessimistic, the US dollar could rebound on a stronger headline print.

It is also worth stressing that ADP’s record as a predictor is poor. Historically, NFP has often diverged from the ADP trend — and given August’s drop from 104k to 55k, traders should remain alert to the potential for an upside NFP surprise.

Chart analysis by Matt Simpson - data source: LSEG, BLS, JOLTS

USD/JPY Technical Analysis: US Dollar vs Japanese Yen

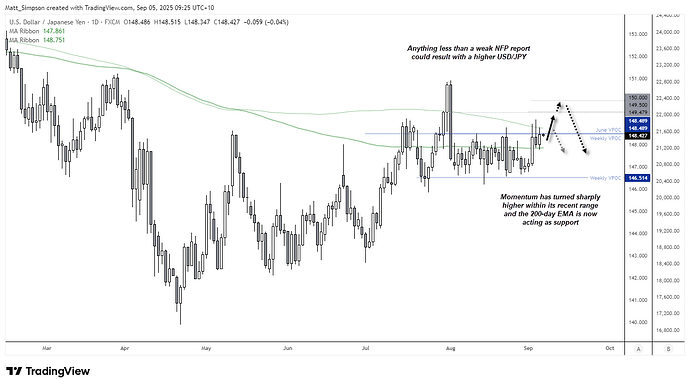

I have previously outlined my bias for an eventual bearish breakout of the recent range on USD/JPY’s daily chart. While the band between the two volume point of controls (VPOCs) has provided solid range-trading opportunities, momentum has now turned decisively against yen bulls.

Tuesday’s extended bullish range expansion candle closed firmly above the 200-day EMA, with price spiking intraday through the upper VPOC before settling just beneath it — a strong hint of an impending breakout. The 200-day EMA is now acting as support, reinforcing the bullish case.

Although the 200-day SMA remains a resistance cap, anything short of a notably weak Nonfarm Payrolls (NFP) report — especially one accompanied by higher unemployment — risks wrongfooting USD/JPY bears. Otherwise, a stronger US dollar looks increasingly likely as markets head into the weekend.

Chart analysis by Matt Simpson - data source: TradingView USD/JPY

Key Economic Events for Traders (AEST / GMT+10)

09:30 JPY Household Spending, Wage Income, Overtime Pay, Foreign Reserves (USD/JPY, EUR/JPY, Nikkei 225)

15:00 JPY Coincident Indicator, Leading Index (USD/JPY, EUR/JPY, Nikkei 225)

16:00 GBP Core Retail Sales, Halifax House Price Index, Retail Sales (GBP/USD, EUR/GBP, FTSE 100)

16:00 EUR German Factory Orders (EUR/USD, EUR/GBP, DAX)

17:00 CHF Foreign Reserves, SECO Consumer Climate (USD/CHF, EUR/CHF, CHF/JPY)

19:00 GBP Mortgage Rate (GBP/USD, EUR/GBP, GBP/JPY)

19:00 EUR Employment Change, Employment Overall, GDP (Q2) (EUR/USD, EUR/JPY, DAX)

21:30 CAD Leading Index (USD/CAD, EUR/CAD, CAD/JPY)

22:30 USD Average Hourly Earnings, Average Weekly Hours, Payrolls (Government, Manufacturing, Nonfarm, Private), Participation Rate, U6 Unemployment Rate, Unemployment Rate (S&P 500, Nasdaq 100, USD/JPY, Gold, Crude Oil)

22:30 CAD Average Hourly Wages, Employment Change, Full Employment Change, Part Time Employment Change, Participation Rate, Unemployment Rate (USD/CAD, EUR/CAD, CAD/JPY)

00:00 CAD Ivey PMI (USD/CAD, EUR/CAD, CAD/JPY)

View the full economic calendar

– Written by Matt Simpson

Follow Matt on Twitter u/cLeverEdge

The information on this web site is not targeted at the general public of any particular country. It is not intended for distribution to residents in any country where such distribution or use would contravene any local law or regulatory requirement. The information and opinions in this report are for general information use only and are not intended as an offer or solicitation with respect to the purchase or sale of any currency or CFD contract. All opinions and information contained in this report are subject to change without notice. This report has been prepared without regard to the specific investment objectives, financial situation and needs of any particular recipient. Any references to historical price movements or levels is informational based on our analysis and we do not represent or warranty that any such movements or levels are likely to reoccur in the future. While the information contained herein was obtained from sources believed to be reliable, author does not guarantee its accuracy or completeness, nor does author assume any liability for any direct, indirect or consequential loss that may result from the reliance by any person upon any such information or opinions.

Futures, Options on Futures, Foreign Exchange and other leveraged products involves significant risk of loss and is not suitable for all investors. Losses can exceed your deposits. Increasing leverage increases risk. Spot Gold and Silver contracts are not subject to regulation under the U.S. Commodity Exchange Act. Contracts for Difference (CFDs) are not available for US residents. Before deciding to trade forex, commodity futures, or digital assets, you should carefully consider your financial objectives, level of experience and risk appetite. Any opinions, news, research, analyses, prices or other information contained herein is intended as general information about the subject matter covered and is provided with the understanding that we do not provide any investment, legal, or tax advice. You should consult with appropriate counsel or other advisors on all investment, legal, or tax matters. References to FOREX.com or GAIN Capital refer to StoneX Group Inc. and its subsidiaries. Please read Characteristics and Risks of Standardized Options.