Hi @tommor, interesting observation.

Although there are many varying components why this or that market does or does not trade well, my own experience over the years came to the same conclusion, I would say, about 10 years ago.

My trading background started as a trader in an international bank FX dealing room. Inevitably, this meant working primarily with currencies in spot, forwards, and futures markets.

Business was primarily based on customer currency requirements, funding foreign currency commercial loans and the bank’s own exposures. Private trading was not allowed.

Later, after moving to a non-banking employment, I started trading for myself and initially followed the same patterns and procedures that I had already absorbed from my bank days.

However, it was not long before I realised that there was little similarity between the world of institutional functioning in the FX market and my own tiny microcosm of a few pips in a few hours with a tight SL constraint on getting it right often enough to make it all worthwhile!

So I moved to commodities, specifically USOil, and that was a much improved environment. All nations use oil and most buy it in USD and the associated geopolitical events were both interesting and well-documented.

But it was not long before oil prices were tending to follow just economic issues such as Trumps previous trade wars with China for example. And I found that I was watching the SP500 in order to decide my trades in Oil. So it was a logical step to move over entirely to SP500.

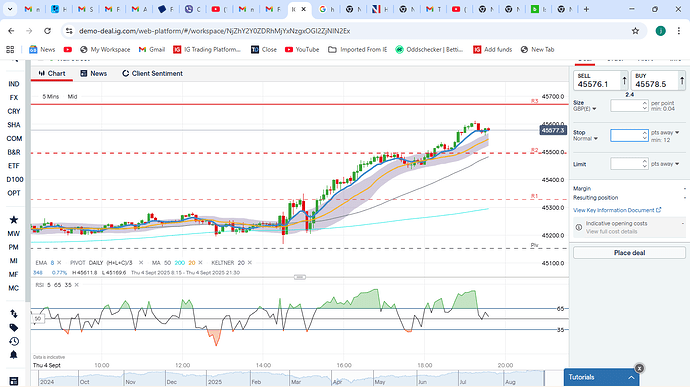

So I did that - and I have never looked back since (except for a brief digression to Bitcoin, but that is so boring!). The SP500 moves far and fast, making it viable for shorter timeframes, and it is based on a broad coverage of the overall health and direction of the US economy.

It is also a big market for major pension and investment funds as well as wealthy individual and so the longer term charts give a good and accurate indication of their longer term activities as well as the underlying direction of the market.

The indices markets are based on both concrete changes in economic health as well as sentiment-driven interpretation of current issues. And underlying all that is the need for a huge amount of funds to be placed somewhere…

But it is not wise to assume that indices are simply a “buy and hold and make lots of money” type market. Sure, the value may move up over the years, but there are also long periods of stagnation and reversal that would create large drawdowns and years of waiting for a recovery. Who wants to wait 2-5 years in order to get back to profit - even if they can theoretically sit through the interim drawdown?

But roller-coasters are not always just long-term either. Just look at the drop in US markets immediately following Trumps “Liberation Day” tariffs - and the subsequent successive number of ATH’s that followed that…

But, in general, I think indices are easier to analyse, have greater follow-through, and are supported by a constant source of funds looking for a home - and offer a chunky reward for effort even on the smaller, intraday, timeframes.

I don’t do back-testing. Markets change over time and what fitted in the past does not necessarily fit in the future. And. anyway, it is not really possible to back-test PA accurately, where interpretation is as much an art as a science and it is impossible to automate where one’s levels would have been and how one would have reacted at that time - and with what size position, etc. I prefer evolvement through forward- testing and adapting with the current weather formations. Isn’t that, afterall, where the fun and interest lies in trading? Following and living what is going on in the world today and how the markets are reacting now and what might follow tomorrow?

Funny how I find the same thing in driving. All I seem to hear and read nowadays is how cars are more and more automated and doing everything for you including braking and lane control. Even getting my car out of the garage is accompanied by a cacophany of peeps and buzzes and coloured lights as the warning sensors and cameras follow the outline of the walls and objects!

But I like driving!!! I don’t want my car to tell me what to do and when and even do it for me! I don’t want cruise controls and other comforts - I want to drive my car myself because I enjoy doing so - and it is the same with trading. I want to make my decisions based on my own interpretion of what is going on now and what might happen next. I don’t want to be tied by what happened last time in similar circumstances two years ago, etc. This world is changing fast and radically. The past is becoming progressively irrelevant as these changes develop and close in on our markets.

However, this is not to say that trading indices is easy. Getting it wrong is expensive and SL levels have to give generous allowance for noise and there is extra need for placing special emphasis on getting in at a good level.

But, as usual, this is just my way. We all need to define what we are looking for, how we want to find it, and what tools we are going to need.

Long live indices.