Over the past three trading sessions, the EUR/USD has consistently lost ground, accumulating a decline of just over 0.6% in the short term. Selling pressure remains firm amid uncertainty surrounding the release of NFP data in the United States.

By : Julian Pineda, CFA, Market Analyst

Over the past three trading sessions, the EUR/USD has consistently lost ground, accumulating a decline of just over 0.6% in the short term. Selling pressure remains firm amid uncertainty surrounding the release of NFP data in the United States, as the market awaits how these results could influence the Federal Reserve’s monetary policy.

Click the website link below to read our exclusive Guide to EUR/USD trading in Q2 2025

https://cityindex.com/en-uk/market-outlooks-2025/q2-eur-usd-outlook/

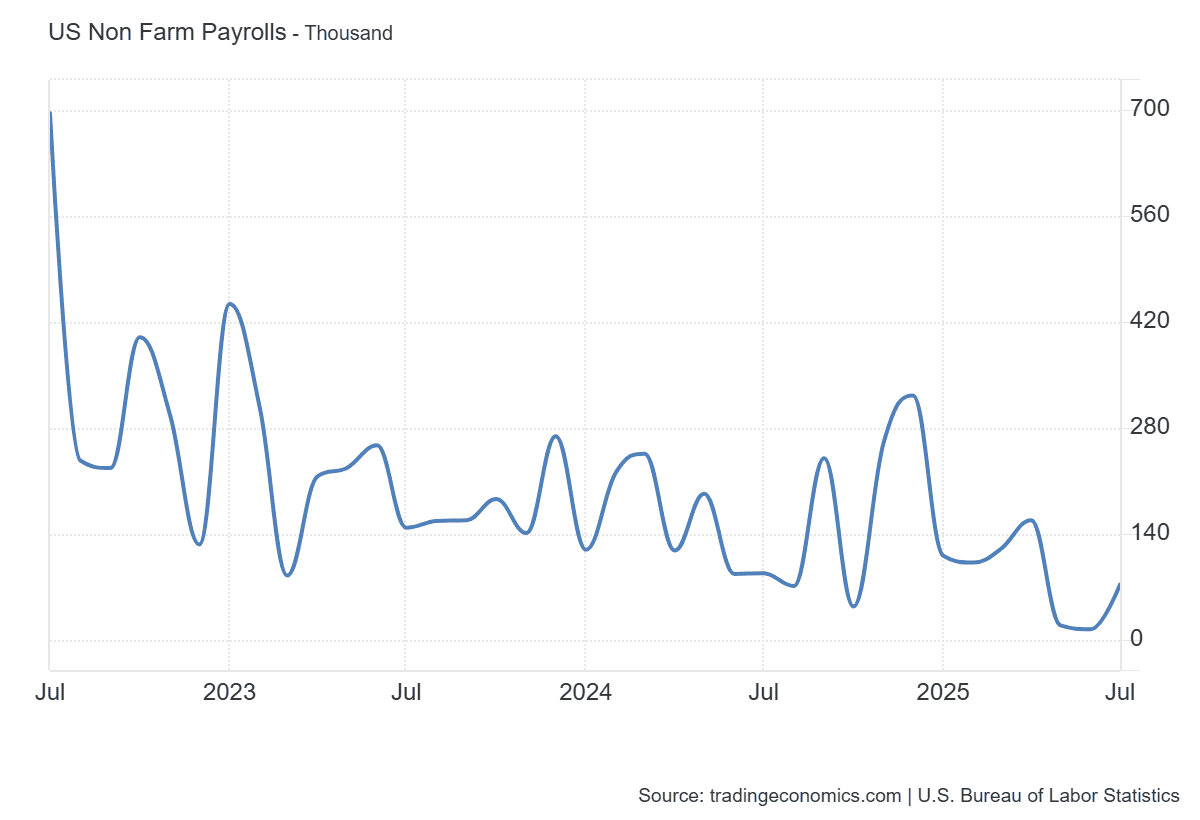

What to Expect from Employment?

Tomorrow, the NFP report and the U.S. unemployment rate will be released, fueling speculation about the short-term labor outlook. Weekly jobless claims came in at 237,000, above the 230,000 expected, suggesting there is no major problem in the labor market. However, this figure is insufficient to anticipate with precision how many jobs were created last month, which will be revealed by the nonfarm payrolls data.

Expectations for the current report point to the creation of 75,000 jobs, while the unemployment rate is projected at 4.3%, slightly above 4.2% in the previous month. This trend reinforces the view that U.S. labor activity has weakened significantly: NFP figures have fallen from 323,000 jobs in December 2024 to below 100,000 consistently in recent months. At the same time, the unemployment rate has hovered above 4% in recent releases, confirming a short-term slowdown in employment activity.

Source: TradingEconomics

Against this backdrop, expectations of a weaker labor market have fueled the view of lower interest rates in the U.S. In fact, the CME Group currently shows a 97.6% probability of a 0.25% rate cut at the September 17 meeting. However, if the data surprises to the upside with stronger labor activity, these probabilities could gradually adjust.

Thus, employment has become a key factor for the U.S. dollar: as forecasts continue to show a constant slowdown in job creation that supports a cycle of rate cuts, the dollar could lose appeal. In this scenario, buying pressure on the EUR/USD could remain relevant in the coming sessions.

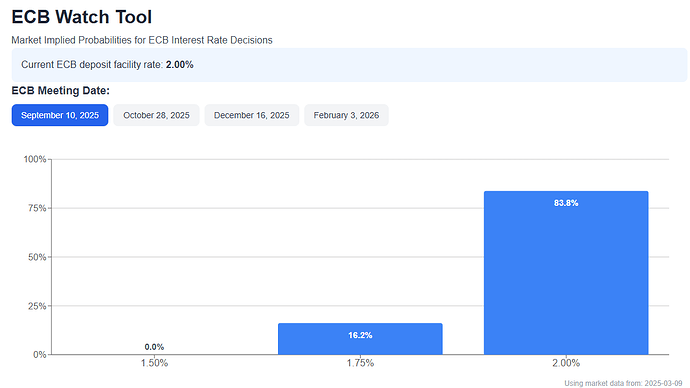

European Central Bank Outlook?

While the market focuses on the Fed, the European Central Bank (ECB) outlook remains more stable. According to the ECB Watch Tool, there is an 83.8% probability that the interest rate will remain at 2.00% in the next meeting on September 10, in line with ECB comments suggesting that the current rate is stable and unlikely to change in the short term.

Source: ECBWATCH

In this scenario, a neutral rate policy in Europe alongside expectations of lower rates in the U.S. could increase the attractiveness of euro-denominated instruments. If tomorrow’s employment data confirm U.S. labor weakness and reinforce the Fed’s dovish outlook, demand for dollars could weaken further, favoring the euro and sustaining buying pressure on EUR/USD.

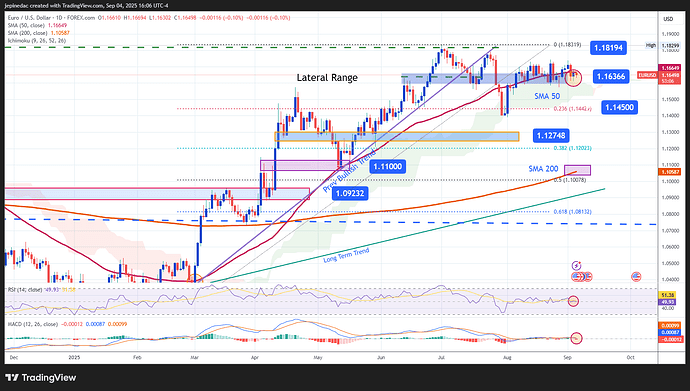

EUR/USD Technical Outlook

Source: StoneX, Tradingview

- Sideways Range Holds: The lack of direction in recent weeks has consolidated a sideways range between resistance at 1.18194 and support at 1.14500. Currently, the price remains in the mid-range area, and as long as this behavior continues, sideways trading is likely to dominate in the sessions ahead.

- RSI: remains around the neutral 50 level, reflecting balance between buying and selling momentum over the last 14 sessions. This equilibrium suggests that lack of direction will likely continue in the near term.

- MACD: the histogram oscillates around the 0 line, indicating that short-term moving averages remain neutral. This reinforces the absence of a clear trend as the market awaits employment data.

Key Levels:

-

1.18194 – Relevant Resistance: corresponds to the yearly highs and represents the most important barrier for buyers. A sustained breakout above this level could open the way to new highs, consolidating a more defined bullish bias.

-

1.16366 – Near-Term Barrier: coincides with the 50-period moving average. Price action around this level highlights continued lack of direction in the short term.

-

1.14500 – Final Support: corresponds to the 23.6% Fibonacci retracement and is the most critical support. A move down to this zone could imply a structural shift toward a more consistent bearish bias.

Written by Julian Pineda, CFA – Market Analyst

Follow him at: @julianpineda25

https://cityindex.com/en-uk/news-and-analysis/eurusd-forecast-the-euro-weakens-ahead-of-nfp/

StoneX Financial Ltd (trading as “City Index”) is an execution-only service provider. This material, whether or not it states any opinions, is for general information purposes only and it does not take into account your personal circumstances or objectives. This material has been prepared using the thoughts and opinions of the author and these may change. However, City Index does not plan to provide further updates to any material once published and it is not under any obligation to keep this material up to date. This material is short term in nature and may only relate to facts and circumstances existing at a specific time or day. Nothing in this material is (or should be considered to be) financial, investment, legal, tax or other advice and no reliance should be placed on it.

No opinion given in this material constitutes a recommendation by City Index or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although City Index is not specifically prevented from dealing before providing this material, City Index does not seek to take advantage of the material prior to its dissemination. This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

For further details see our full non-independent research disclaimer and quarterly summary.